Enter Password

SIMPLIFY & PROTECT YOUR BUSINESS STRUCTURE — ALL-IN-ONE TAX & LEGAL SETUP

Whether you’re ready to incorporate, add a holding company, or establish a family trust, CloudSide Advisory makes it seamless. We combine CPA-level tax strategy with a senior tax lawyer (formerly partner at a top national firm) — one virtual team, one flat fee, zero confusion.

MOST BUSINESS OWNERS OUTGROW THEIR STRUCTURE WITHOUT REALIZING IT

As profits grow, your original setup can start costing you: higher taxes, personal liability, or missed estate-planning opportunities. A smart corporate structure protects your assets, minimizes tax, and sets up your family for the future.

TAX + LEGAL UNDER ONE ROOF

Most accountants send you to a lawyer. Most lawyers send you back to your accountant.

We’ve fixed that. CloudSide Advisory works directly with a senior tax lawyer who left a major Bay-Street-level firm to build a modern virtual practice. Together, we’ve streamlined every step — collecting information once, coordinating filings, and delivering complete legal and accounting setup in record time.

Key Highlights:

One Flat Fee – Accounting + Legal included

Senior Tax Law Expertise – formerly partner at a prestigious firm

Virtual & Efficient – no office overhead → competitive pricing

Streamlined 4-Step Process – faster, less paperwork

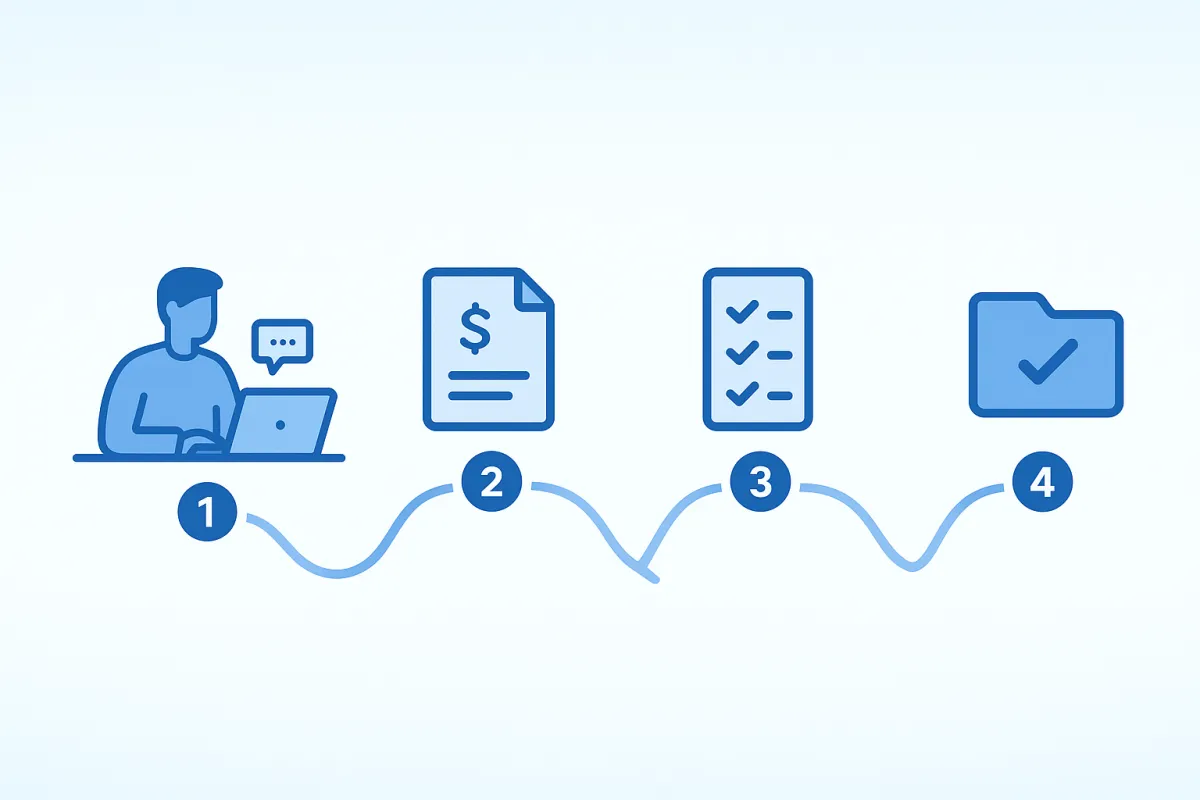

OUR STREAMLINED 4-STEP SETUP PROCESS

Book Your Consultation – We discuss your goals and confirm whether you need an incorporation, holding company, or trust.

Get Your Fixed Quote – One flat fee covers the full legal + accounting setup.

Complete Our Info Form – Secure online form collects everything the lawyer and CPA need.

We Handle the Setup – Incorporation and registrations filed; share structures, tax accounts, and documentation delivered in a shared portal.

THREE PATHS tO a SMARTER CORPORATE STRUCTURE

Each mini-section functions as its own micro-landing page below.

INCORPORATION

HOLDING COMPANY

FAMILY TRUST

INCORPORATE YOUR BUSINESS — PROTECT YOUR ASSETS AND KEEP MORE OF WHAT YOU LEARN

The smartest move a growing sole proprietor can make — gain legal protection, unlock tax advantages, and look more credible overnight.

When you incorporate, your business becomes its own legal entity. That means your personal assets are protected if the business faces risk, and you can leave profits in the corporation to defer personal tax.

Our joint CPA + tax lawyer team sets everything up: incorporation, CRA accounts, GST/HST, payroll, minute book, and initial share structure.

You’ll also receive a personalized onboarding call with both the CPA and lawyer to understand how to pay yourself (salary vs. dividends), how to record expenses properly, and how to stay fully compliant from day one.

Key Benefits:

Protect personal assets – limited liability for business debts

Reduce taxes – defer and split income strategically

Boost credibility – appear established to lenders and clients

Build for growth – easy to add partners or investors later

ADD A HOLDING COMPANY — SHIELD PROFITS AND BUILD LONG-TERM FLEXIBILITY

The structure used by savvy Canadian business owners to protect retained earnings, invest tax-efficiently, and prepare for future growth.

A Holding Company (HoldCo) sits above your operating company. It allows you to move money out of the business through tax-free inter-corporate dividends, so your cash is safe if something happens in the operating company.

It also lets you invest retained profits in real estate, market portfolios, or other ventures without triggering personal tax.

Our CPA + tax lawyer team designs the share structure, files all legal documents, and aligns the accounting treatment so everything works seamlessly together.

The result: you keep your wealth protected, liquid, and ready for opportunities.

Key Benefits:

Asset protection – safeguard profits from lawsuits or creditors

Tax-free flow-through – move money between companies without tax

Investment flexibility – invest corporate cash tax-efficiently

Succession ready – simpler transitions or future sale of the OpCo

SET UP A FAMILY TRUST — PROTECT WEALTH AND CREATE GENERATIONAL FLEXIBILITY

The cornerstone of advanced tax and estate planning — control your assets today and build a lasting legacy for your family.

A properly structured family trust allows income and capital gains to be allocated among family members, reducing overall tax and simplifying succession.

It can own shares of your holding or operating companies, letting you move value efficiently while maintaining control.

When it’s time to pass assets down, the trust framework avoids costly probate and keeps your affairs private.

Our CPA + tax lawyer team designs the trust, drafts the legal documents, and ensures alignment with your corporate structure.

You’ll also receive guidance on how to use the trust annually for tax planning and future estate transitions.

Key Benefits:

Income splitting – distribute income among family members

Asset protection – shield business value from personal liability

Estate planning – smooth, tax-efficient transfer of wealth

Privacy & control – avoid probate and maintain discretion

THE CLOUDSIDE ADVANTAGE

One Flat Fee for Accounting + Legal

no surprises, one invoice.

Senior Tax Law Partner Involved

expert legal oversight without big-firm overhead.

CPA Supervision at Every Step

CRA-compliant and optimized for tax efficiency.

Virtual and Efficient

save time without sacrificing quality

.

OUR TRANSPARENCY GUARANTEE

FIXED PRICING

What we quote is what you pay. No hidden fees.

TIMELY DELIVERY

If we miss our agreed timeline after receiving all documents, you get a credit.

EXPERT OVERSIGHT

Every structure reviewed by a Canadian CPA and a senior tax lawyer.

Frequently Asked Questions

You have questions, we’ve got answers:

Do I need a lawyer and an accountant?

Not anymore — our joint team handles both in one engagement.

Is this offered Canada-wide?

Yes — 100 % virtual and CRA compliant nationwide.

How long does setup take?

Incorporations ≈ 2 weeks, HoldCos ≈ 3 weeks, Trusts ≈ 3–4 weeks after intake.

What does “fixed fee” mean?

We quote the total price before work begins — covering both legal and accounting components.

Will I still own the legal documents and minute book?

Yes — you own everything. We simply set it up and hand over secure copies.

Build a Structure That Protects What You’ve Built

Book a consultation with CloudSide Advisory and our senior tax law partner to plan your incorporation, holding company, or family trust — all in one seamless process.

FOLLOW US

Services

Company

Newsletter

Receive our monthly Newsletter with Tax Tips Learn confidently how to select that next great accountant.

By Subscribing you Agree with our Privacy Policy and provide consent to receives updates from our company.

Copyright 2025. Mukul Singh's Account. All Rights Reserved.